self employment tax deferral calculator

This income is typically reported on schedule c profit or loss from business or schedule h for household employees of your tax return. If you were working a typical full-time job your employer would take your Social Security and Medicare taxes out of your paychecks each pay period.

What Americans Should Know About Reporting Income Taxes In Germany

Maximum deferral of self-employment tax payments calculator.

. According to the IRS self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401 a of the Internal Revenue Code on net earnings from self-employment income for the period beginning on March 27 2020 and ending December 31 2020. The self-employment tax for the 2021 tax year the taxes most people will be paying by April 18 of 2022 stands at 153. There are a number of exceptions for ministers and members of religious orders in regards to self-employment tax liability.

The Coronavirus Aid Relief and Economic Security Act allowed self-employed individuals and household employers to defer the payment of certain Social Security taxes on their Form 1040 for tax year 2020 over the next two. For 2021 the first 142800 of your combined wages tips and net earnings is subject to any combination of the Social Security part of self-employment tax. Unfortunately you may have missed the SKIP option when it first started that section and since it was started TurboTax will complete it.

Complete Edit or Print Tax Forms Instantly. If you are self-employed your Social Security tax. Section 1401 allows self-employed taxpayers to deduct 50 of Social Security taxes paid between March 27 and December 31.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. To be considered paid on time 50 of the deferred amount is to be repaid by December 21 2021 and the remaining amount must be paid back by December 31 2022. This amount will not be included in self-employment taxes owed on the 2020 return.

Generally it applies to self-employment earnings of 400 or more. Above the line deductions - IRS approved items that can be subtracted from net income. The self-employment tax is 153 which is 124 for Social Security and 29 for Medicare.

Ad Free means free and IRS e-file is included. If you have employees you can defer the 62 employer portion of Social Security tax for March 27 2020 through December 31 2020. Firstly you need to enter the annual salary that you receive from your employment and if applicable any overtime or pension details.

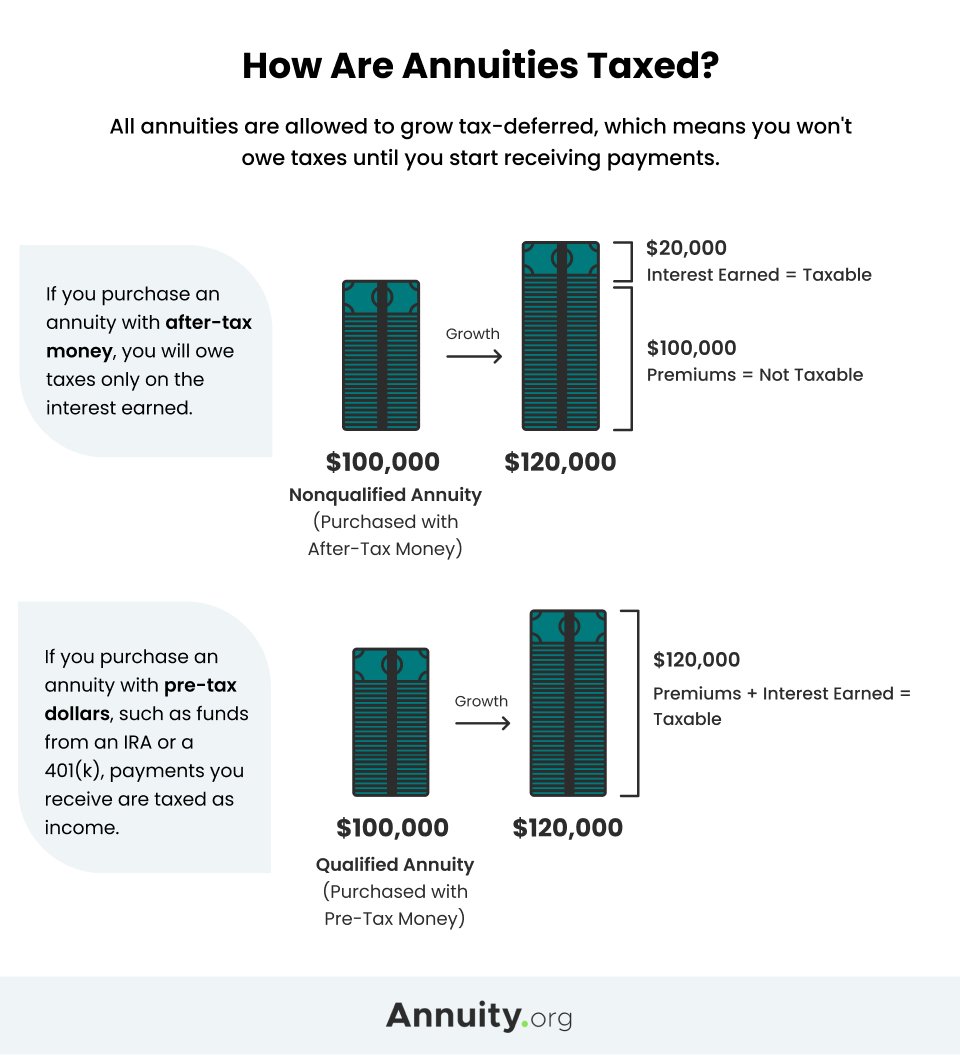

Tax deferral can help you grow your money faster since the value is not being reduced by annual income taxes each year. Ad Calculate and Compare a Normal Taxable Investment to Two Common Tax Advantaged Situations. In 2022 income up to 147000 is subject to the 124 tax paid for the Social Security portion of self-employment taxes FICA.

For example if you paid 5000 in Social Security taxes on self-employment income enter 2500 on Line 18 of Schedule SE. Adjusted Gross Income AGI is your net income minus above the line deductions. 2 Taxes deferred on gains.

Once you know how much of your net earnings are subject to tax its time to apply the 153 additional tax rate. Benefit of Tax Deferral Calculator. Please see the detailed instructions for self-employment taxes as provided by the IRS.

You will pay 62 percent and your employer will pay Social Security taxes of 62 percent on the first 128400 of your covered wages. Self employment taxes are comprised of two parts. Income subject to SE taxes 9235 614 SE Taxes 93 153 of 614 12 SE Taxes 46.

Use this simple calculator to quickly calculate the tax and other deductions that are taken from income from self employment. The calculator took one of these for you known as the self employment deduction. Self-employed individuals are responsible for paying both portions of.

1 Taxes are assessed and paid on the gains each year. Free Calculator to Help Compare Taxable Investment to 2 Common Tax Advantaged Situations. NerdWallet and the IRS both also note that a 09 Medicare tax may be added to net earnings that exceed 200000 for single filers or 250000.

The calculator needs some information from you before working out your tax and National Insurance. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Instead earnings and any untaxed contributions are taxed at ordinary income rates when you begin taking withdrawals from tax-deferred investments.

You just input your turnover and associated costs select the period for those figures and add any options required. This section is also known as the maximum deferral line18. Therefore in tax year 2020 Social Security tax only applies to the first 137700 of your.

Ad Access Tax Forms. Employees who receive a W-2 only pay half of the total Social Security 62 and Medicare 145 taxes while their employer is responsible for paying the other half. Max refund is guaranteed and 100 accurate.

Keep in mind there is a 10 IRS tax penalty that may apply for taxable. Elective deferral for Employee. You each also pay Medicare taxes of 145 percent on all your wages - no limit.

Estimate and compare the future value difference between a taxable product and a tax-deferred product. See The Hartford Business Playbook for more. The federal tax rates in the drop-down box are scheduled to be in effect from 2018-2025.

However it will need to be repaid. Up to 10 cash back Self-employment tax consists of Social Security and Medicare taxes for individuals who work for themselves. Self-employed taxpayers can also postpone the payment of 50 of the Social Security portion of their self-employment tax for the same period.

However the deferred payments must still be made. To see how this works check out our Self-Employment Tax Calculator. Your tax code age and other options might.

Then enter your annual income and outgoings from self-employment. Half of the deferred Social Security tax is due by December 31 2021 and the remainder is due by December 31 2022. But note that social security tax is applied on maximum maxed 137700 for the tax year 2020 This was 132000 for 2019.

This is the basis for many other calculations made. The self-employment tax calculator explains the math. Your employment wages and tips should have a 62 deduction for Social Security from your pay and an additional 62 payment from your employer that does not appear on your paycheck.

Free tax filing for simple and complex returns. Although the location of the maximum. This covers your Social Security and Medicare taxes.

The self-employment tax rate is 153. Take the guesswork out and use our calculator to determine your self-employment taxes. Roughly 9235 of your self-employment earnings will be subject to self-employment tax.

The total self-employment tax rate is 153 comprising of 124 for Social Security and 29 for Medicare for both 2020 and 2019. When does the deferred amount need to be repaid. This calculator gets you a full breakdown of the deductions on your profits with minimum inputs required.

Since TurboTax is trying to calculate a tax deferral payment for self-employment tax then you need to go back into that section of your return and enter that you want 0 self employment tax deferred. The maximum limit set for elective deferral is 19500 for 2020. Social Security and Medicare.

Guaranteed maximum tax refund. The rate consists of two parts. Social Security tax deferral.

The maximum amount you can contribute to your solo 401k as an employee. The law sets a maximum amount of net earnings that is subject to the social.

Remitting The First Installment Of Deferred Social Security Taxes Bkd

What Is Payroll Tax Deferral And How Does It Affect Small Businesses

Deferred Social Security Tax Payments Due Today For Employers Self Employed Njbia

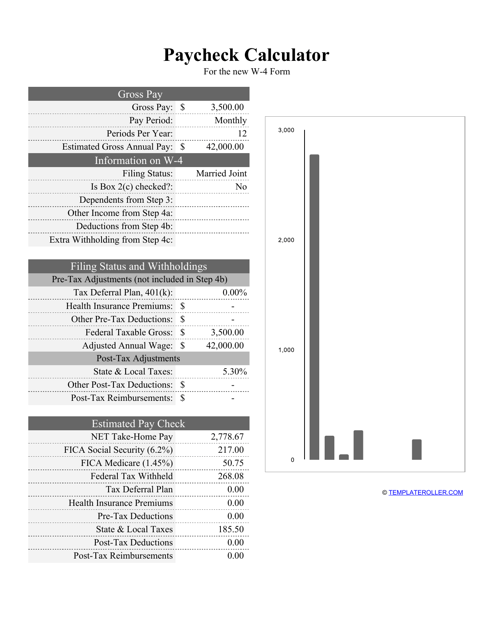

Free Payroll Forms Fill Pdf Online Print Templateroller

Solved Turbotax Is Trying To Calculate A Tax Payment Defe

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Tax Deferral How Do Tax Deferred Products Work

Us Deferral Of Employer Payroll Taxes Help Center

Understanding Solo 401 K After Tax Total Additions Limit For Sole Proprietorship Bogleheads Org

Us Deferral Of Employee Fica Tax Help Center

Employers Can Defer Payroll Taxes Cobb

Newsletter Foreign Law Investments Luther Rechtsanwaltsgesellschaft Mbh

Temporary Payroll Tax Deferral What You Need To Know Coastal Wealth Management

Schedule Se Self Employment Faqs 1099m 1120s K1 Schedulec Schedulese W2

Payroll Tax Deferral How Will It Affect You Experian

Some Light Shed On Repayment Of Social Security Tax Suspension

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Us Deferral Of Employee Fica Tax Help Center

Can I Still Get A Self Employment Tax Deferral Shared Economy Tax